В наши дни очень актуально применение электрического теплого пола, преимущественно при подогреве керамической плитки, обогреве лоджии, бани либо веранды. Также такие полы используют как дополнение к основному виду отопления. Укладка такого пола достаточно проста, если следовать инструкциям.

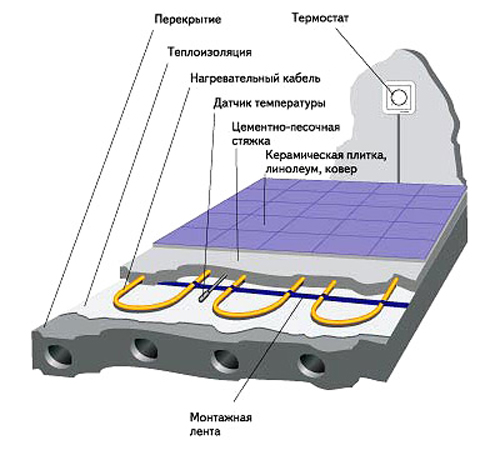

Схема теплого электрического пола

Структуру электрического пола начиная от нижнего слоя следующая:

- основной черновой пол из бетона, который необходимо выполнять максимально ровно, без впадин и бугорков, чтобы не пережечь кабель;

- теплоизолирующая неплавкая подложка под электрический пол, например, пенополистирол либо пенополиэтилен с отражающим слоем из фольги толщину, которой подбирают соответственно температурным нагрузкам;

- крепежная система, представляющая собой монтажную ленту либо арматурную сетку;

- нагревательный кабель с наличием температурного датчика, который подает информацию на терморегулятор;

- заливка специальной смеси для теплых полов либо цементно-песочная стяжка толщиной около 3-5 сантиметров;

- напольное финишное покрытие, в большинстве случаев плитка, но возможна прокладка и иного покрытия.

Материалы

Электрический теплый пол бывает двух разновидностей :

- Пол, который сформирован методом самостоятельной укладки кабеля нагревания.

- Пол с нагревательными матами, то есть стеклосетка, в которой имеется уже проложенный кабель.

Принципиального отличия между этими разновидностями нет. В первом случае имеется свобода режима обогрева и расположения кабеля, а также возможность использования нагревательного кабеля, как для основной, так и для дополнительной системы отопления. Маты же, как правило, используют для дополнительного обогрева.

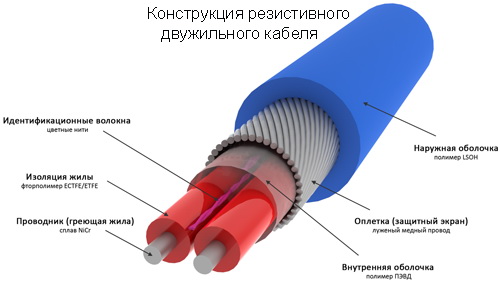

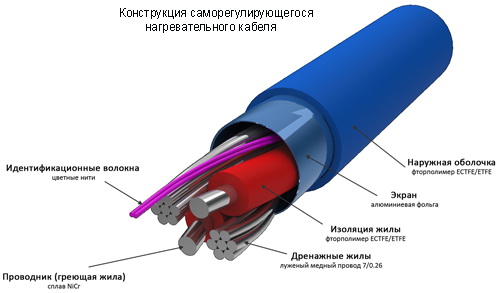

Кабели в свою очередь бывают резистивные и саморегулирующиеся.Резистивный состоит из одной либо двух жил, которые обладают повышенным сопротивлением. Он также называется одножильным либо двужильным.

Двужильные кабели довольно просты в монтаже и оборудованы системой рассеивания электромагнитного излучения намного лучше. Саморегулирующийся кабель немного отличается по конструкции.

В данном случае, исходя из своей конструкции, по всей длине кабеля происходит процесс самостоятельной регуляции силы тока, влияющей на нагревательный элемент. Благодаря этому кабель не перегревается на каком-либо участке и не нарушает систему обогрева, в отличие от кабеля первого типа. Однако такой вариант обходится дороже по цене.

Порядок работы

При формировании электрического пола важен правильный расчет мощности системы обогрева для конкретного помещения. Также температуру пола следует учесть при подборе покрытия пола. Общие данные для помещений различного типа следующие:

- в спальне — 100 -150 Вт/кв.м;

- в коридоре, кухне и прихожей комнате — 150 Вт/кв.м;

- в ванной и туалете — 180 Вт/кв.м;

- на балконе или в лоджии — 200 Вт/кв.м.

Так или иначе рекомендуется обратиться к услугам специалиста, который точно определит нужную мощность и поможет подобрать нужные материалы. Таким же образом должна составляться схема электрического теплового пола. Участие специалиста также необходимо при подключении системы и проведении от распределительного щита дополнительной усиленной линии проводки. Монтажные работы же можно проводить самостоятельно.

Выравнивание полов и укладка теплоизоляции

В случае, если теплый пол служит в качестве основного источника обогрева следует обязательно применить слой теплоизоляции, толщина которого зависит от того, что уложено непосредственно под покрытием пола. Лучше всего для этого подходит пенополистирол 35-ой плотности. Для помещений выше первого этажа при наличии внизу отапливаемого помещения достаточно применить утеплитель толщиной 2 сантиметра. Для помещений же первого этажа с наличием отапливаемого подвала рекомендуется применение утеплителя толщиной 3 сантиметра. Для помещений первого этажа без отапливаемых подвалов, балконов, а также помещений, находящихся над арочными сквозными пролетами следует использовать утеплитель толщиной не менее 5 сантиметров, а в домах с бетонной подушкой, лежащей на грунте – 10 сантиметров.

Слой теплоизоляции можно прикрепить при помощи специальных дюбелей либо уложить на специальный клей. Полы необходимо делать ровными, без ям, трещин и перекосов. В обратном случае трещины заделываются цементным раствором, а при перекосе делается черновая стяжка и выравнивается пол. Перед укладкой теплоизоляции поверхность обрабатывается грунтовкой, которая препятствует образованию плесени, а при склеивании слоя теплоизоляции благодаря грунтовке повышается сцепление материалов между собой. Плиты клеятся либо закрепляются в нескольких местах посредством дюбелей. По поверхности фиксируют штукатурную сетку при помощи пластиковых плит либо дюбелей с шайбами, равными по длине толщине слоя теплоизоляции. Такой крепеж дополнительно прикрепляет к полу плиты.

Расчет кабеля

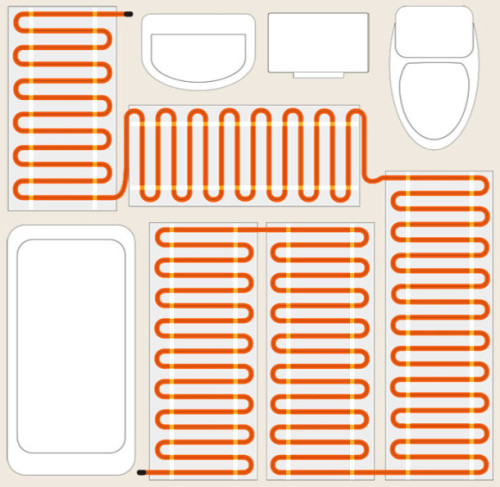

Кабель должен покрывать поверхность помещения на 80% площади всего помещения. На 1 квадратный метр закладывается мощность в рамках 180-200 Вт/ м². Необходимо до укладки проверить сопротивление секций кабеля. Допустимо отклонение около 10% в обе стороны от показателя, указанного в техпаспорте. Кабель не прокладывается в местах нахождения бытовой техники, крупногабаритной мебели без опорных ножек. От стен отступают на 5-7 сантиметров. Далее рассчитывается шаг для укладки кабеля. В сантиметрах шаг равняется площади обогрева, умножаемой на 100 и делимой на длину кабеля. До укладки кабеля следует учесть то, что секция одножильного кабеля соединяется с нагревательным проводом в двух концах, а у двужильного кабеля с одного.

Подготовительные работы

Чтобы установить терморегулятор в стене на месте крепления вырезается углубление и проделывается штроба до пола. Посредством алебастра крепят монтажную коробку для терморегулятора. Из нее выходит гофрированная трубка, которая укладывается в штобру и замазывается алебастром. Конец трубки на 40 сантиметров заводят в зону обогрева, расположив ее так, чтобы термодатчик находился между витками кабеля в центре. У трубы не должно быть резких изгибов. Под ее конец, на место расположения датчика, подкладывается материал для возвышения для того, чтобы датчик находился почти под полом, правильно фиксируя температуру. Трубку на конце следует плотно закрыть с помощью изоленты для предотвращения попадания в нее раствора при стяжке.

Укладка кабеля

Кабель располагают змейкой, при этом соблюдают вычисленный шаг. Можно зафиксировать его к металлической сетке при помощи пластиковых стяжек минимальной длины. Затем после укладки проверяется и записывается сопротивление кабеля, зарисовывается схема расположения витков кабеля, включается и проверяется работоспособность системы. После этого все отключается, снимается терморегулятор до завершения работ по отделке пола.

I have noticed that fixing credit activity needs to be conducted with techniques. If not, you will probably find yourself damaging your rank. In order to reach your goals in fixing your credit ranking you have to be careful that from this second you pay your entire monthly expenses promptly before their scheduled date. It is really significant because by definitely not accomplishing that, all other activities that you will decide to try to improve your credit positioning will not be efficient. Thanks for discussing your strategies.

Thanks for your article. I would love to comment that the first thing you will need to accomplish is verify if you really need credit improvement. To do that you simply must get your hands on a replica of your credit report. That should not be difficult, since the government mandates that you are allowed to acquire one absolutely free copy of your own credit report on a yearly basis. You just have to ask the right persons. You can either browse the website for your Federal Trade Commission or contact one of the main credit agencies specifically.

Thanks for your post. One other thing is that individual states have their unique laws of which affect home owners, which makes it quite difficult for the the nation’s lawmakers to come up with a new set of guidelines concerning foreclosed on house owners. The problem is that each state features own regulations which may have impact in an adverse manner in regards to foreclosure policies.

In line with my observation, after a in foreclosure home is offered at a bidding, it is common with the borrower in order to still have a remaining balance on the bank loan. There are many loan merchants who make an effort to have all service fees and liens repaid by the upcoming buyer. Nonetheless, depending on particular programs, regulations, and state guidelines there may be many loans that aren’t easily settled through the shift of financial loans. Therefore, the obligation still remains on the consumer that has acquired his or her property in foreclosure process. Many thanks for sharing your ideas on this website.

Thanks for the suggestions you are sharing on this blog. Another thing I’d really like to say is getting hold of copies of your credit rating in order to examine accuracy of each and every detail is one first action you have to carry out in credit restoration. You are looking to clean up your credit reports from dangerous details problems that screw up your credit score.

According to my observation, after a foreclosed home is bought at a bidding, it is common for that borrower to still have the remaining balance on the financial loan. There are many loan companies who attempt to have all charges and liens paid back by the subsequent buyer. Nevertheless, depending on particular programs, rules, and state guidelines there may be a few loans that aren’t easily resolved through the switch of financial loans. Therefore, the obligation still remains on the debtor that has had his or her property in foreclosure process. Many thanks sharing your thinking on this site.

Thanks for discussing your ideas on this blog. Likewise, a fairy tale regarding the lenders intentions whenever talking about foreclosure is that the financial institution will not getreceive my repayments. There is a certain amount of time that this bank will take payments here and there. If you are as well deep in the hole, they should commonly desire that you pay that payment in full. However, that doesn’t mean that they will have any sort of repayments at all. If you and the loan company can be capable to work something out, the foreclosure process may stop. However, if you continue to pass up payments under the new plan, the property foreclosure process can pick up where it left off.

Thanks for your post. I would love to remark that the first thing you will need to complete is determine whether you really need credit score improvement. To do that you have got to get your hands on a replica of your credit history. That should never be difficult, ever since the government necessitates that you are allowed to obtain one totally free copy of your credit report yearly. You just have to inquire the right people today. You can either find out from the website for your Federal Trade Commission or maybe contact one of the leading credit agencies directly.

Thanks for the tips on credit repair on all of this site. The thing I would offer as advice to people should be to give up the mentality that they may buy at this moment and pay back later. Being a society all of us tend to try this for many factors. This includes holidays, furniture, along with items we want. However, it is advisable to separate one’s wants from the needs. If you are working to boost your credit score make some sacrifices. For example you possibly can shop online to save money or you can turn to second hand merchants instead of highly-priced department stores pertaining to clothing.

In accordance with my study, after a in foreclosure home is available at an auction, it is common for the borrower to still have the remaining balance on the loan. There are many creditors who make an effort to have all charges and liens paid back by the subsequent buyer. Having said that, depending on specific programs, polices, and state laws and regulations there may be quite a few loans which aren’t easily settled through the transfer of lending options. Therefore, the responsibility still lies on the consumer that has acquired his or her property foreclosed on. Thank you for sharing your thinking on this blog.

Thanks for the suggestions about credit repair on this particular site. Some tips i would offer as advice to people should be to give up the particular mentality that they’ll buy currently and pay back later. Like a society most of us tend to do this for many things. This includes family vacations, furniture, and items we want. However, you have to separate one’s wants from all the needs. When you are working to fix your credit score you really have to make some sacrifices. For example you may shop online to economize or you can check out second hand stores instead of high-priced department stores for clothing.

Thanks for the strategies you are giving on this blog site. Another thing I would like to say is the fact getting hold of duplicates of your credit report in order to scrutinize accuracy of each and every detail could be the first activity you have to accomplish in credit restoration. You are looking to thoroughly clean your credit reports from harmful details mistakes that mess up your credit score.

In accordance with my research, after a in foreclosure home is sold at a sale, it is common with the borrower to be able to still have some sort ofthat remaining unpaid debt on the personal loan. There are many financial institutions who attempt to have all service fees and liens paid back by the subsequent buyer. On the other hand, depending on certain programs, restrictions, and state regulations there may be many loans which are not easily settled through the transfer of loans. Therefore, the duty still remains on the lender that has acquired his or her property in foreclosure process. Thank you sharing your ideas on this blog.

I have noticed that fixing credit activity should be conducted with techniques. If not, you are going to find yourself damaging your ranking. In order to succeed in fixing to your credit rating you have to be careful that from this minute you pay your monthly expenses promptly prior to their scheduled date. It is significant for the reason that by not necessarily accomplishing this, all other measures that you will decide on to improve your credit rating will not be successful. Thanks for expressing your thoughts.

Thanks for discussing your ideas with this blog. Furthermore, a misconception regarding the financial institutions intentions whenever talking about foreclosed is that the financial institution will not have my installments. There is a degree of time that the bank will take payments every now and then. If you are far too deep inside hole, they should commonly demand that you pay that payment 100 . However, i am not saying that they will not take any sort of installments at all. In the event you and the standard bank can manage to work something out, a foreclosure approach may stop. However, in the event you continue to miss payments underneath the new strategy, the property foreclosure process can just pick up where it was left off.

According to my study, after a in foreclosure home is available at a sale, it is common with the borrower to be able to still have a remaining balance on the financial loan. There are many loan companies who try to have all fees and liens paid back by the next buyer. On the other hand, depending on particular programs, laws, and state legal guidelines there may be a number of loans that aren’t easily sorted out through the exchange of lending products. Therefore, the duty still falls on the consumer that has received his or her property in foreclosure process. Thank you sharing your thinking on this website.

Thanks for your post. I would also like to comment that the first thing you will need to do is verify if you really need fixing credit. To do that you simply must get your hands on a duplicate of your credit rating. That should not be difficult, ever since the government necessitates that you are allowed to acquire one no cost copy of your actual credit report yearly. You just have to check with the right people today. You can either look at website with the Federal Trade Commission or maybe contact one of the main credit agencies directly.

In my opinion that a foreclosed can have a major effect on the applicant’s life. House foreclosures can have a 6 to decade negative impact on a debtor’s credit report. Any borrower who have applied for a home loan or almost any loans for example, knows that your worse credit rating is definitely, the more difficult it is to obtain a decent mortgage loan. In addition, it might affect a new borrower’s chance to find a reasonable place to let or rent, if that will become the alternative real estate solution. Great blog post.

Thanks for your article. I would love to say this that the first thing you will need to complete is to see if you really need repairing credit. To do that you simply must get your hands on a duplicate of your credit rating. That should never be difficult, considering that the government necessitates that you are allowed to receive one free copy of your actual credit report every year. You just have to check with the right men and women. You can either check out the website owned by the Federal Trade Commission or maybe contact one of the main credit agencies instantly.

In accordance with my research, after a property foreclosure home is sold at an auction, it is common for your borrower in order to still have some sort ofthat remaining balance on the financial loan. There are many loan companies who aim to have all fees and liens paid off by the following buyer. However, depending on selected programs, laws, and state regulations there may be many loans which aren’t easily settled through the exchange of lending options. Therefore, the responsibility still remains on the lender that has had his or her property in foreclosure process. Many thanks sharing your opinions on this website.

I’ve really noticed that repairing credit activity has to be conducted with tactics. If not, you might find yourself endangering your ranking. In order to succeed in fixing to your credit rating you have to be careful that from this moment in time you pay your entire monthly expenses promptly before their appointed date. It is significant on the grounds that by not really accomplishing so, all other activities that you will decide to use to improve your credit positioning will not be useful. Thanks for revealing your tips.

Thanks for your submission. I would love to say that the first thing you will need to perform is to see if you really need fixing credit. To do that you will need to get your hands on a copy of your credit file. That should never be difficult, because the government necessitates that you are allowed to have one free copy of your actual credit report on a yearly basis. You just have to inquire the right people. You can either look at website with the Federal Trade Commission and also contact one of the major credit agencies straight.

In my opinion that a foreclosures can have a important effect on the borrower’s life. Foreclosures can have a 6 to a decade negative relation to a debtor’s credit report. A borrower who’s applied for home financing or virtually any loans as an example, knows that the worse credit rating can be, the more tricky it is to acquire a decent mortgage. In addition, it can affect any borrower’s power to find a decent place to lease or rent, if that turns into the alternative property solution. Great blog post.

Based on my research, after a in foreclosure home is marketed at a sale, it is common for the borrower to still have some sort ofthat remaining unpaid debt on the mortgage loan. There are many creditors who aim to have all service fees and liens paid off by the upcoming buyer. Even so, depending on particular programs, restrictions, and state regulations there may be quite a few loans that are not easily sorted out through the switch of loans. Therefore, the duty still falls on the debtor that has acquired his or her property foreclosed on. Thanks for sharing your thinking on this site.

Thanks for giving your ideas with this blog. Likewise, a fable regarding the banks intentions if talking about property foreclosure is that the bank will not have my payments. There is a specific amount of time that this bank will need payments occasionally. If you are also deep inside hole, they may commonly call that you pay the particular payment completely. However, that doesn’t mean that they will have any sort of installments at all. When you and the lender can find a way to work something out, the actual foreclosure approach may stop. However, if you continue to neglect payments under the new approach, the foreclosures process can just pick up exactly where it was left off.

Thanks for your submission. I would love to comment that the very first thing you will need to conduct is to see if you really need repairing credit. To do that you must get your hands on a duplicate of your credit profile. That should never be difficult, because the government necessitates that you are allowed to obtain one free of charge copy of your own credit report annually. You just have to ask the right folks. You can either look at website for the Federal Trade Commission or contact one of the major credit agencies instantly.

Thanks for your write-up. I would also love to opinion that the first thing you will need to carry out is determine if you really need fixing credit. To do that you have got to get your hands on a copy of your credit rating. That should really not be difficult, considering that the government makes it necessary that you are allowed to be issued one no cost copy of your real credit report every year. You just have to request that from the right persons. You can either find out from the website with the Federal Trade Commission as well as contact one of the major credit agencies directly.

One thing I’ve noticed is that often there are plenty of misguided beliefs regarding the financial institutions intentions if talking about foreclosure. One fable in particular is the fact that the bank wants your house. The lending company wants your hard earned cash, not your house. They want the funds they loaned you with interest. Avoiding the bank is only going to draw the foreclosed final result. Thanks for your article.

Another thing I’ve really noticed is that for many people, less-than-perfect credit is the reaction of circumstances past their control. For example they may are already saddled having an illness so they really have higher bills for collections. It would be due to a employment loss or inability to go to work. Sometimes divorce process can really send the financial circumstances in the undesired direction. Many thanks sharing your notions on this blog site.

I think that a property foreclosures can have a significant effect on the debtor’s life. House foreclosures can have a Several to few years negative effect on a debtor’s credit report. Any borrower who may have applied for home financing or any loans as an example, knows that your worse credit rating is definitely, the more hard it is to secure a decent bank loan. In addition, it could possibly affect a new borrower’s power to find a really good place to let or rent, if that turns into the alternative housing solution. Thanks for your blog post.

Another thing I have really noticed is the fact for many people, bad credit is the result of circumstances outside of their control. As an example they may are already saddled by having an illness so they really have high bills going to collections. It can be due to a occupation loss or even the inability to work. Sometimes separation and divorce can send the financial situation in the undesired direction. Thank you for sharing your opinions on this blog.

Thanks for the useful information on credit repair on this web-site. What I would advice people would be to give up the particular mentality that they’ll buy at this moment and pay out later. As being a society all of us tend to repeat this for many factors. This includes holidays, furniture, along with items we wish. However, you should separate your current wants out of the needs. While you are working to raise your credit ranking score you have to make some trade-offs. For example it is possible to shop online to save money or you can click on second hand merchants instead of highly-priced department stores regarding clothing.

Hi there, You’ve done a great job. I will certainly digg it and personally suggest to my friends. I am sure they’ll be benefited from this site.

Another thing I’ve really noticed is that often for many people, bad credit is the consequence of circumstances outside of their control. For example they may be actually saddled through an illness and because of this they have more bills for collections. It may be due to a work loss or maybe the inability to go to work. Sometimes divorce can truly send the funds in the wrong direction. Many thanks sharing your opinions on this weblog.

Another thing I’ve really noticed is that often for many people, a bad credit score is the reaction of circumstances beyond their control. By way of example they may have already been saddled by having an illness so they have substantial bills going to collections. Maybe it’s due to a occupation loss and the inability to work. Sometimes divorce proceedings can really send the finances in the wrong direction. Thank you for sharing your notions on this weblog.

I have really noticed that repairing credit activity ought to be conducted with techniques. If not, chances are you’ll find yourself endangering your standing. In order to reach your goals in fixing your credit rating you have to ascertain that from this minute you pay your complete monthly fees promptly in advance of their booked date. It is really significant on the grounds that by not really accomplishing this, all other moves that you will decide to use to improve your credit ranking will not be useful. Thanks for giving your tips.

Thanks for the tips on credit repair on your site. What I would tell people should be to give up the actual mentality they will buy now and pay out later. Like a society we tend to make this happen for many things. This includes getaways, furniture, plus items we would like. However, you need to separate one’s wants out of the needs. When you are working to fix your credit score you have to make some trade-offs. For example you may shop online to save money or you can look at second hand stores instead of high priced department stores for clothing.

Thanks for the concepts you are sharing on this blog site. Another thing I want to say is getting hold of duplicates of your credit file in order to scrutinize accuracy of any detail is one first step you have to undertake in credit restoration. You are looking to clean up your credit reports from dangerous details errors that spoil your credit score.